Equity - Value of Your Business

You've heard of equity - but do you really know what it is?

The most common example most people know is home equity. Home equity is the part of the home you fully own and do not pay a mortgage on. In other words, the value of your home minus the mortgage left to pay.

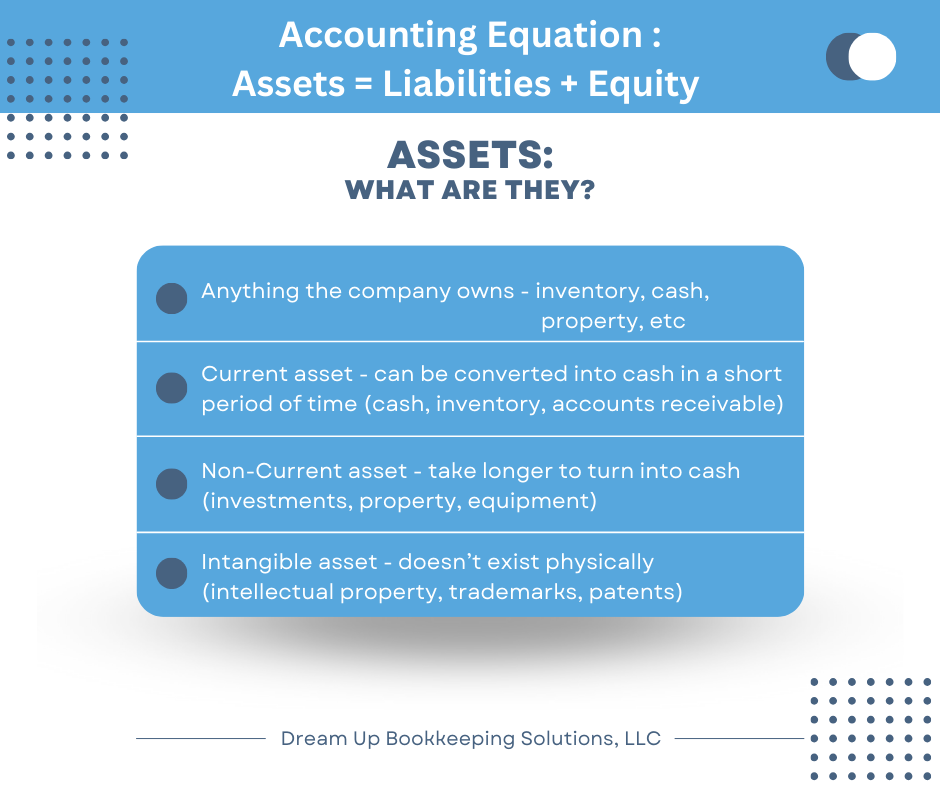

You can transfer this idea to business as well. The value of your home is an asset, while the mortgage left to pay is a liability. So, equity = assets - liabilities. This equation gives you your net assets and tells you the general value of your business.

Another way to look at this is equity can be your profit. Net profit is your revenue minus your expenses. This is what you own, much like the part of the house you own. This profit can then be divided among shareholders and/or owners. It's some of the equity they have in the business.

Want to know the total equity of your business? Take the value of all your assets after being liquidated and subtract all the debt. The amount left is the equity of the company.

If you keep up-to-date and accurate books, you can determine your equity by looking at your balance sheet.